Friday, 17 December 2021

Ingersoll Rand (US) and Atlas Copco (Sweden) are Leading Players in the Liquid Ring Vacuum Pumps Market

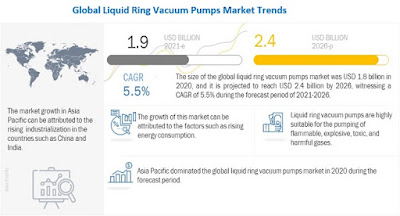

The liquid ring vacuum pumps market size was USD 1.8 billion in 2020 and is projected to reach USD 2.4 billion by 2026, at a CAGR of 5.5% from 2021 to 2026, owing to rising gas transportation sector. The oil & gas segment is the biggest application for liquid ring vacuum pumps. The growing investments in the crude oil industry is expected to drive the use of liquid ring vacuum pumps.

The key market players include Busch Vacuum Solutions (Germany), Flowserve Corporation (US), Atlas Copco (Sweden), Ingersoll Rand (US), Tsurumi Manufacturing Co., Ltd (US), DEKKER Vacuum Technologies, Inc. (US), Vooner (US), Graham Corporation (US), Cutes Corp. (China), Zibo Zhaohan Vacuum Pump Co., Ltd (China), OMEL (Brazil), PPI Pumps Pvt. Ltd. (Mexico), Samson Pumps (Denmark), and Speck (Germany). These players have adopted product launches, agreements, acquisitions, mergers & acquisitions, and expansions as their growth strategies.

To know about the assumptions considered for the study download the pdf brochure

Ingersoll Rand is among the leading manufacturers in the liquid ring vacuum pumps market. The company designs and produces a broad range of vacuum products under industrial technologies & services segment. In February 2020, the company acquired and merged with the industrial business of Ingersoll-Rand plc while converting its name to Ingersoll Rand Inc. from Gardner Denver Holdings, Inc. This development strengthened the position of Ingersoll Rand as a global leader in the liquid ring vacuum pumps market.

Another important player in the liquid ring vacuum pumps market is Atlas Copco. In February 2019, Atlas Copco launched LRP 700-1000 VSD+, a new range of liquid ring vacuum pumps. The pumps come with cutting-edge vacuum solutions with a wide range of features for wet and humid applications. This launch strengthens the position of Atlas in the liquid ring vacuum pumps market with new product development.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=231761054

Thursday, 2 December 2021

North America to continue the similar growing trend in the 3D printing high performance plastic market

The global 3D printing high performance plastic market is expected to grow from USD 72 million in 2020 to USD 202 million by 2025, at a CAGR of 22.9% during the forecast period. Increasing demand from high end-use industries, growing novel application in tooling and proptotying, and government supportive activities to promote the usage of 3D printing materials is driving the growth of the market.

To know about the assumptions considered for the study download the pdf brochure

North America held the largest share in 3D printing high performance plastic market and is projected to continue the similar trend over the projected period. Manufacturers of 3D printing materials in North America are putting efforts by undertaking new product launch, collaboration, and other strategies. For instance, in September 2018, Stratasys Ltd. signed a multi-year technical partnership with Team Penske (US). Team Penske will be using advanced materials, such as Carbon Fiber-filled Nylon 12, in additive manufacturing for advanced car testing, production parts, and prototypes. The partnership is aimed at innovating new materials in 3D printing to increase output and improve vehicle performance.

Some of the key players in the global 3D printing high performance plastic market are: – Arkema S.A. (France) https://www.arkema.com/global/en/ – Royal DSM N.V. (the Netherlands): https://www.dsm.com/corporate/home.html – Stratasys, Ltd. (US): https://www.stratasys.co.in/ – 3D Systems Corporation (US): https://www.3dsystems.com/ – EOS GmbH Electro Optical Systems (Germany): https://www.eos.info/en These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the 3D printing high performance plastic industry. The study includes an in-depth competitive analysis of these key players in the 3D printing high performance plastic market, with their company profiles, recent developments, and key market strategies.

Recent Developments

- In July 2020, Victrex, a global leader in high-performance PEEK and PAEK polymer solutions, launched VICTREX AM 200 Filament which has been specifically designed and optimized for additive manufacturing. The filament is PAEK-based and is in high demand for high-performance parts owing to its excellent mechanical properties..

- In October 2019, Solvay Group introduced KetaSpire PEEK XT, the industry’s first true high-temperature PEEK. This innovative material provides the chemical resistance of standard PEEK plus with significantly higher stiffness and strength at elevated temperature. KetaSpire PEEK XT delivers the exceptional chemical resistance of PEEK along with higher glass transition temperature and higher melting temperature than standard PEEK.

Subscribe to:

Comments (Atom)

Non-Biodegradable Plastics to Lead Bioplastics & Biopolymers Market During Forecast Period

In recent years, there has been a growing awareness that the use of non-biodegradable plastics is leading to large amounts of plastic waste ...

-

The global polylactic acid market is projected to reach $43.7 billion by 2024, growing at a CAGR of 5.2% from 2018. The industry is charact...

-

The global propylene glycol market was valued at USD 3.47 Billion in 2016, and is projected to grow at a CAGR of 5.8%, to reach USD 4.60 ...

-

In recent years, there has been a growing awareness that the use of non-biodegradable plastics is leading to large amounts of plastic waste ...