Wednesday, 27 October 2021

The residential segment is expected to lead the polymer modified cementitious coatings market

The polymer modified cementitious coatings market in 2020 is estimated at USD 1.1 billion and is projected to reach USD 1.5 billion by 2025, at a CAGR of 6.5% from 2020 to 2025. The growth of this market can be attributed to the increasing demand for polymer modified cementitious coatings from the residential buildings sector. In addition, government initiatives to support infrastructural developments in the Asia Pacific region are anticipated to drive the growth of the polymer modified cementitious coatings market.

Based on application, the residential buildings segment led the polymer modified cementitious coatings market in 2016. The growth of the residential buildings segment can be attributed to the increasing use of polymer modified cementitious coatings in various residential applications, such as exterior walls, driveways & sidewalks, and floorings. Furthermore, the growth of the real estate market in emerging countries of Asia Pacific and the Middle East & Africa has contributed to the growth of the polymer modified cementitious coatings market in the residential buildings segment.

To know about the assumptions considered for the study download the pdf brochure

Two-component segment is projected to lead the polymer modified cementitious coatings market

Increasing demand for higher durability and flexibility is expected to drive the market for two-component polymer modified cementitious coatings. The two-component coating material possesses high flexibility, abrasion resistance, impact resistance, and water resistance properties. the increasing disposable incomes of the populations of emerging countries are leading to the high demand for superior quality products, which is expected to drive the market during the forecast period.

Acrylic polymers segment accounts for the largest share of the polymer modified cementitious coatings market

The acrylic polymers segment is estimated to lead the polymer modified cementitious coatings market in 2020, due to the rising demand due to increasing use of acrylic-based polymer modified cementitious coatings in residential buildings applications. Further, acrylic-based polymer modified cementitious coatings are low in alkali content, fast-setting, and high strength properties. These are also used for patching small cracks, holes, honeycombs, and surface defects over half-inch in depth. They are used in waterproofing floors, columns, beams, slabs, loading docks, and precast walls. They are also used for the protection of concrete structures from vapor, chloride ions, acidic gas, and alkali attacks.

Asia Pacific is expected to witness the fastest growth in the polymer modified cementitious coatings market during the forecast period

The polymer modified cementitious coatings market in the Asia Pacific region is projected to grow at the highest CAGR between 2020 and 2025. China, India, and Japan together accounted for the major share of the Asia Pacific polymer modified cementitious coatings market in 2019. The Asia Pacific region is an emerging and lucrative market for polymer modified cementitious coatings, owing to industrial development and improving economic conditions. This region constitutes approximately 60% of the world’s population, and thus leads to the wide-scale use of polymer modified cementitious coatings for waterproofing applications in residential and non-residential buildings, and public infrastructure. Outbreak of COVID-19 from China and the impact of coronavirus in Japan, South Korea, Autralia, and India has caused a decrease in the consumption of polymer modified cementitoi.

Major companies such as Arkema S.A. (France), Sika AG (Switzerland), Akzo Nobel N.V. (Netherlands), MAPEI S.p.A. (Italy), Compagnie de Saint-Gobain S.A. (France), and Fosroc International Limited (UAE) , Dow, Inc. (US) and H.B. Fuller Company (US) The Lubrizol Corporation (US), Organik Kimya Sanayi Ve Ticaret A.S. (Turkey), Pidilite Industries Limited (India), GCP Applied Technologies Inc. (US), Berger Paints India Limited (India), W. R. Meadows, Inc. (US), Evercrete Corporation (US), Indulor Chemie GmbH (Germany), The Euclid Chemical Company (US) and others are key players in the polymer modified cementitious coatings market.

Don’t miss out on business opportunities in Polymer Modified Cementitious Coatings Market. Speak to our analyst and gain crucial industry insights that will help your business grow.

Tuesday, 26 October 2021

Ultra-High Molecular Weight Polyethylene Market worth $2.2 billion by 2025

The ultra-high molecular weight polyethylene (UHMW PE) market is estimated at USD 1.4 billion in 2020 and is projected to reach USD 2.2 billion by 2025, at a CAGR of 9.4% from 2020 to 2025. The growth of this market can be attributed to the increasing demand for UHMW PE from the aerospace & defense industry and increased demand for orthopedic implants. In addition Increasing R&D and mass production of ballistic fibers and compliance with various legal and administrative bodies is expected to create opprtuities in the market which is expected to drive the market during the forecast period. Furthermore, outbreak of COVID-19 pandemic is anticipated to hamper the consumption of UHMW PE which affects the market growth.

To know about the assumptions considered for the study download the pdf brochure

Sheet segment is estimated to lead the UHMW PE market, during the foreast period

By form, the sheets segment is estimated to account for a major share of the UHMW PE market in 2019. This large share is mainly attributed to the extensive use of sheets in the aerospace, defense, & shipping industries for the manufacture of aircraft interiors & mechanical equipment industries for the manufacture of conveyer belts. Rods & tubes are the second most used form of UHMW PE used majorly in the mechanical equipment industry.

Healthcare & Medical is projected to grow at the highest CAGR of the UHMW PE market

Based on end-use industry, the healthcare & medical segment is expected to grow at the highest CAGR in 2019. In the healthcare & medical industry, there is a high demand for UHMW PE for the manufacture of orthopedic implants and parts for medical devices due to properties such as high strength to weight ratio, self-lubrication, and impact resistance. The growing demand for orthopedic implants from developed countries is expected to fuel the growth of the UHMW PE market globally.

Asia Pacific is expected to witness the fastest growth in the UHMW PE market during the forecast period

The UHMW PE market in the Asia Pacific region is projected to grow at the highest CAGR between 2020 and 2025. China, India, and Japan together accounted for the major share of the Asia Pacific UHMW PE market in 2019. The Asia Pacific region is an emerging and lucrative market for UHMW PE, owing to industrial development and improving economic conditions. In addition, the growth of the medical industry in Asia Pacific is one of the reason leading to an increase in the demand for UHMW PE. UHMW PE is also being used in mechanical equipment. The presence of a number of mechanical component manufacturing plants in China and rapid industrialization in Asia Pacific are expected to drive the UHMW PE market in the coming years.

Major companies such as Celanese Corporation (US), Koninklijke DSM N.V. (Netherlands), LyondellBasell Industries N.V. (Netherlands), Braskem S.A (Brazil), Asahi Kasei Corporation, (Japan) Du Pont De Nemours Inc. (US), Saudi Arabia Basic Industries Corporation (Saudi Arabia), Mitsui Chemicals, Inc. (Japan), Honeywell International, Inc. (US), and Teijin Limited (Japan) and others are key players in the UHMW PE market.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=257883188

Friday, 22 October 2021

Atkore International Group Inc. (US) and Hubbell Incorporated (US) are the Key Players in the Electrical Conduit Market

The global electrical conduit market is estimated to be USD 6.5 billion in 2021 and is projected to reach USD 9.1 billion by 2026, at a CAGR of 6.9% from 2021 to 2026. The driving factors for the electrical conduit market is rapid pace of industrialization and urbanization, and rise in demand for electricity or power generation across the globe. The growth of the electrical conduit market is supported by increasing awareness regarding public safety and the implementation of safety regulations by governments.

Atkore International Group Inc. (US), Hubbell Incorporated (US), Legrand S.A. (France), Schneider Electric SE (France), and Sekisui Chemical Co., Ltd. (Japan) among others, are the leading electrical conduit manufacturers, globally. These key players have focused on market consolidation by adopting both organic and inorganic growth strategies such as mergers & acquisitions. These companies adopted acquisitions as the key growth strategy between 2019 and 2021.

To know about the assumptions considered for the study download the pdf brochure

Atkore International Group Inc. is one of the largest player in the electrical conduit market. It engages in the manufacture of electrical raceway products, primarily for the non-residential construction and renovation markets. It operates through the Electrical Raceway and Mechanical Products and Solutions (MP&S) segments. Some of its products include electrical conduit and fittings, armored cable and fittings, cable trays, mounting systems and fittings, metal framing, and in-line galvanized mechanical tube. These are critical components of electrical infrastructure for new construction as well as for operational systems under maintenance. The company operates through 37 manufacturing facilities and 28 distribution facilities. Major subsidiaries of the company include Allied Tube & Conduit (Italy), Calpipe Industries (Spain) and Unistrut Limited (UK).

Hubbell Incorporated is the second-largest player of the global electrical conduit market. The company is a manufacturer of electrical, lighting, and power components worldwide. It operates through two segments, namely Electrical Solutions and Utility Solutions. The company offers electrical conduit products and solutions under its electrical segment. The electrical segment manufactures wiring and electrical products, lighting fixtures and controls for indoor and outdoor applications, as well as lighting and communications products. The company offers its products and solutions to various industries such as non-residential & residential construction, industrial, and energy-related (oil and gas) markets.

The company has a presence in Singapore, China, India, Mexico, South Korea, and countries in the Middle East and has a joint venture in Taiwan and Hong Kong. Hubbell has its subsidiaries in the US, Canada, Switzerland, Puerto Rico, China, Mexico, Italy, the UK, Brazil, Australia, and Ireland. It operates through 52 manufacturing facilities and 18 warehouses. Some of the key brands through which the company serves its products are Bell, Raco, Gleason Reel, Bryant, and Wiegmann.

Read More: https://www.marketsandmarkets.com/PressReleases/electrical-conduit.asp

Wednesday, 20 October 2021

General Electric Company (US) and Doosan Lentjes GmbH (Germany) are Leading Players in the Flue Gas Desulfurization Systems Market

The FGD systems market is projected to grow from USD 17.7 billion in 2020 to USD 23.1 billion by 2025, at a CAGR of 5.5% from 2020 to 2025. The Asia Pacific region dominated the FGD system market in 2019. The major driver for the growth of the market in this region is the growth of the coal-fired power generation and cement manufacturing industries, among others. The market in this region is growing considerably and India is likely to be a major hotspot over the next five years.

Mitsubishi Heavy Industries Group (Japan), General Electric Company (US), Doosan Lentjes GmbH (Germany), Babcock & Wilcox Enterprises Inc. (US), Rafako S.A. (Poland), FLSmidth & Co. (Denmark), Hamon Group (Belgium), Marsulex Environmental Technologies (US), Thermax Group (India), and Andritz AG (Austria) have adopted agreements, expansions, innovative technology research, and new product development as their key growth strategies. The other noteworthy players in this market are Ducon Technologies Inc. (US), Chiyoda Corporation (Japan), China Boqi Environmental (Holding) Co. Ltd. (China), LAB S.A. (France), Valmet Corporation (Finland), Kawasaki Heavy Industries Group (Japan), Macrotek Inc. (Canada), China Everbright International Ltd. (China), AECOM (US), Burns & McDonnell (US), Rudis Trbovlje (Slovenia), Steinmuller Engineering GmbH (Germany), Shandong Baolan Environmental Protection Engineering Co. Ltd. (China), IDE Technologies (Israel), and KC Cottrell (South Korea). These players have adopted strategies such as expansions, agreements, and new product development to enhance their position in the market.

To know about the assumptions considered for the study download the pdf brochure

In February 2020, Mitsubishi Hitachi Power Systems (MHPS) received a 12 year maintenance service extension for the BLCP power station in Thailand. This agreement covers maintenance of major equipment, including boilers, steam turbines and flue gas cleaning systems. This agreement will strengthen the service business of the company and boost revenue generation.

In July 2020, General Electric (GE) Steam Power signed an agreement with NTPC Limited, India, for the supply of wet FGD systems for 3 coal-fired power plants. With these wet FGD systems, the company will help NTPC treat approximately 35 million cubic meters per hour of flue gas meeting India’s thermal power plant emission norms for SO2. This agreement also allows GE to strengthen its foothold in the country in which it already has 15.28 GW of SO2 reduction systems.

In July 2019, Doosan Lentjes announced the delivery and commissioning of two FGD systems in Vietnam. This system deployed seawater FGD technology and was installed at the Vinh Tan 1 power plant, Binh Thuan province, Vietnam. Doosan Lentjes’ scope of work included engineering and delivery of key FGD equipment along with advisory services for erection and commissioning. This development establishes the company’s reputation as a specialist in the delivery of air quality control systems across the global utility, municipality, and industrial sectors.

In September 2019, Rafako S.A. entered into an agreement with PGE GiEK S.A. for a comprehensive upgrade of the FGD systems on units 8 to 12 at the Belchatow power plant. This agreement will provide Rafako a revenue of approximately USD 80 million and will strengthen its position as a market leader in the European region.

Read More: https://www.marketsandmarkets.com/PressReleases/flue-gas-desulfurization-systems.asp

Tuesday, 19 October 2021

Covestro AG and BASF SE are leading players in Polyurethane Foams Market

The polyurethane foams market is projected to grow from USD 37.8 billion in 2020 to USD 54.3 billion by 2025, at a CAGR of 7.5% from 2020 to 2025. The major reasons for the growth of the polyurethane foams market include growing end-use industries such as bedding & furniture, electronics, automotive, and building & construction, in emerging economies like India, Thailand, and others. Some of the other like increased use of polyurethane foams in building insulations for energy conservation and versatility and unique physical properties of polyurethane foams are driving factors for growth of polyurethane foams market.

Companies such as Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Dow Inc., and Huntsman Corporation, fall under the winners’ category. These are leading players in the polyurethane foams market, globally, and are some of the leading players operating in the polyurethane foams market. These players have adopted the strategies of expansions, agreements, mergers & acquisitions, partnerships, new product launches, joint ventures, investments & contracts, collaborations, and new technology & new process developments ,to increase their presence in the global market.

To know about the assumptions considered for the study download the pdf brochure

Covestro AG is the leading player in the global polyurethane foams market and is estimated to have the highest share in the market. In February 2020, Covestro AG partnered with Toyota Boshoku Corporation, a subsidiary of Toyota Group (Japan). This partnership aims at jointly developing a new polyurethane composite material for a new electric concept car— LQ— which is developed by Toyota Motor Corporation. This material is a combination of advanced Baypreg F NF technology of Covestro and kenaf fibers of Toyota Boshoku. It is a lightweight and sustainable solution. This polyurethane composite material is expected to be used in door trims of the electric concept car. This partnership is expected to enhance the competitive edge of Covestro AG in the automobile market.

Another important player in the global polyurethane foams market is BASF SE.

In June 2020, BASF SE partnered with China-based Shanghai Zhengming Modern Logistics Co., Ltd. or Zhengming to develop insulating polyurethane (PU) sandwich panels. These panels are used in refrigerated storage of the cold chain industry in China. Under this partnership, BASF SE aims at supplying polyurethanes for all joint cold storage units of Zhengming. This partnership is expected to strengthen the position of BASF SE in the polyurethane foam market of China.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1251

Wednesday, 6 October 2021

Paints & coatings is the largest application in the polymer emulsion market

The global polymer emulsion market size is projected to grow from an estimated value of USD 25.2 billion in 2020 to USD 38.1 billion by 2025, at a CAGR of 8.6% during the forecast period. The growth of the market is driven mainly by the increasing demand from growing end-use industries in emerging markets and stringent regulations regarding VOC emission.

The paints & coatings segment is the largest consumer of polymer emulsion. The growth of the market is attributed to the high demand in industries, such as construction and automotive. Polymer emulsion is used widely in paints & coatings as its manufacturing process has a lower carbon footprint. The high VOC content of solvent-based products and the implementation of government regulations regarding air pollution control has stimulated the development of low VOC paints & coatings. This increased the demand for water-based paints & coatings, which in turn, drive the growth of polymer emulsions in the paints & coatings segment.

To know about the assumptions considered for the study download the pdf brochure

Building & construction is the largest end-use industry in polymer emulsion market

The building & construction end-use industry is the largest consumer of polymer emulsion. The growth of the market in this segment is attributed to the high demand for polymer emulsion in architectural paints, deck & trim paints, and elastomeric wall coatings, among others. Excellent durability and high water resistance drive its demand in the end-use industries.

APAC is projected to be the largest polymer emulsion market

APAC is the largest and fastest-growing market for polymer emulsion. The region is witnessing growth in the polymer emulsion market because of the rapid expansion of building & construction, consumer durables, and transportation sectors. The manufacturers are attracted to the region as skilled labor required for the operation of manufacturing units is available at lower wages. The presence of major polymer emulsion manufacturers and stringent government regulation related to VOC emission are major factors supporting the growth of polymer emulsion in the region.

DIC Corporation (Japan), Dow Chemical Company (US), BASF SE (Germany), Arkema Group (France), Celanese Corporation (US), Trinseo (US), The Lubrizol Corporation (US), Wacker Chemie AG (Germany), Synthomer Plc (UK), and Asahi Kasei Corporation (Japan) are the major players in the polymer emulsion market.

Don’t miss out on business opportunities in Polymer Emulsion Market. Speak to our analyst and gain crucial industry insights that will help your business grow.

Tuesday, 5 October 2021

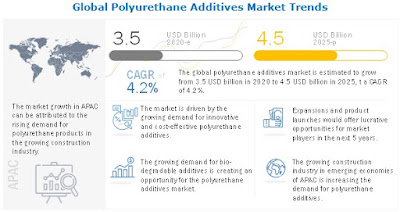

Polyurethane Additives Market Driver: Increasing demand for innovative and cost-effective additives

The polyurethane additives market size is projected to reach USD 4.5 billion by 2025 at a CAGR of 4.2% from 2020. The demand for polyurethane additives market is increasing, owing to the growing demand for innovative and cost-effective additives.

Flexible polyurethane foam is an important material finding usages in mattresses, furniture cushioning, bedding, carpet underlay, automotive interiors, etc. These being highly cellular polymers are easily ignitable. This characteristic limits their greater use in areas that require them to pass certain fire regulations as fire hazards are associated with the use of these polymeric materials, which can cause loss of life and property, are of particular concern among government regulatory bodies, consumers, and manufacturers alike. This further drives the demand for innovating new additives such as flame retardants to reduce the flammability of polyurethanes. A large range of flame retardants such as inorganic phosphorus, organophosphorus, nitrogen, halogen, and phosphorus-halogen based compounds are used to meet the demand for the required additives.

To know about the assumptions considered for the study download the pdf brochure

On the basis of end-use industry, the automotive & transportation segment is estimated to lead the overall polyurethane additives market in 2020.

Polyurethanes are used in various parts of an automobile. In addition to the foam that makes car seats comfortable, bumpers, interior “headline” ceiling sections, the car body, spoilers, doors and windows all use polyurethanes. Polyurethane enables manufacturers to provide drivers and passengers significantly more automobile mileage by reducing weight and increasing fuel economy, comfort, corrosion resistance, insulation, and sound absorption.

On the basis of application, the foams segment is estimated to lead the polyurethane additives market in 2020.

Polyurethane foams are manufactured by reacting polyols and isocyanates in the presence of a blowing agent and an amine catalyst. The blowing agent is carbon dioxide, which is formed as a by-product of the reaction between water and isocyanate. The amine catalyst is known to accelerate the reaction. Polyurethane foams are of two types, namely rigid polyurethane foam and flexible polyurethane foam. Foams offer various properties such as comfort and insulating properties when used in various industries such as automotive and building & construction, which is driving the market.

On the basis of region, APAC is estimated to lead the polyurethane additives market in 2020.

APAC is projected to be the fastest-growing market for polyurethane additives. The rising population, increased demand for automobiles, growing disposable income, rapid industrialization, and increased urbanization are driving the APAC polyurethane additives market. China is the largest market for polyurethane additives in the region. China is also a major producer and consumer of polyurethane additives in the region as it has a huge manufacturing base. Apart from China, India and South Korea are projected to grow at a decent rate during the forecast period.

The key players in the non-phthalate plasticizers market include Evonik Industries (Germany), BASF (Germany), Huntsman Corporation (US), Covestro (Germany), Dow Inc. (US), Lanxess AG (Germany), lbemarle Corporation (US), Tosoh Corporation (Japan), Momentive (US), and BYK (US). These players have established a strong foothold in the market by adopting strategies, such as expansion and new product launch.

Don’t miss out on business opportunities in Polyurethane Additives Market. Speak to our analyst and gain crucial industry insights that will help your business grow.

Monday, 4 October 2021

North America is expected to account for the largest market share in the carbon capture, utilization, and storage market

North America is the largest carbon capture, utilization, and sequestration market owing to the presence of multiple large-scale CCS facilities in the US and Canada. Century plant, Shute Creek Plant, BPundaryy Dam, Petra Nova Plant, ENID Fertiliser plant are some few projects that are operational in eth US and Canada. The carbon capture, utilization, and storage market in North America is expected to be driven by rising environmental concerns in the region. The US Supreme Court proposed a carbon trading scheme, named the US Clean Power Plan in February 2016. This scheme aims at curbing carbon pollution from power plants in the US. Canada, especially Western Canada, is dependent on fossil fuel industries. According to the US EPA, greenhouse gas emissions caused by human activities increased by 7% in the country from 1990 to 2014. The Canadian government has been taking initiatives to reduce carbon emission levels.

The global carbon capture, utilization, and storage market size is expected to grow from USD 1.6 billion in 2020 to USD 3.5 billion by 2025, at a CAGR of 17.0% during the forecast period. The carbon capture, utilization, and storage market are growing due to the increasing usage of CCSU systems in the oil & gas and power generation sector to reduce harmful carbon emissions.

To know about the assumptions considered for the study download the pdf brochure

Capture holds the major share of the carbon capture, utilization, and storage.

Capture is the first stage of the CCUS process and involves capturing CO2 from its emission source. It can be applied to any large-scale emission process, including coal-fired power generation plants; gas and oil production; and manufacturing industries, such as cement, iron, and steel. The capture service segment holds the majority of the share in the CCUS market. Moreover, the high cost of capturing in the power generation, iron & steel, cement, and other sectors is one of the major reasons behind the high market share of the capture segment.

Oil & gas accounted for the largest market share in the global carbon capture, utilization, and storage market in terms of value.

Oil & gas is the dominating end-use industry in the carbon capture, utilization, and sequestration market. Various natural gas processing CCUS projects in MEA, North America, and Europe is key support or the high market size in the oil & gas industry. Increasing usage of EOR in the oil & gas industry is also driving the growth of oil & gas industry in the carbon capture, utilization, and sequestration market

COVID-19 has merely put any effect on the market, which is expected to grow at a significant rate in 2020 as well, owing to continuous investment in the field of carbon capture and sequestration. Currently, CCUS is being largely used across natural gas processing plants and power generation plants. The operations of these plants were not affected by the COVID-19 pandemic; as a result, lockdown imposed due to the pandemic posed very minimal impact on the CCUS market.

Don’t miss out on business opportunities in Carbon Capture, Utilization, and Storage Market. Speak to our analyst and gain crucial industry insights that will help your business grow.

Top Market Players- Impact Modifiers Market

The global impact modifiers market size is estimated at USD 3.9 billion in 2020 and is projected to reach USD 5.0 billion by 2025, at a CAGR of 5.3% from 2020 to 2025. Impact modifiers are additives that enable plastic products to absorb shocks and protect these products from cracking or breaking. The use of impact modifiers improves the properties of polymers, such as impact strength, toughness, and hardness. The amount of impact modifier added depends upon the level of impact resistance needed for end-use applications.

Major companies such as Dow Inc. (US), Lanxess A.G. (Germany), Kaneka Corporation (Japan), Arkema S.A. (France), Mitsubishi Chemical Corporation (Japan), LG Chem Ltd. (South Korea), Shandong Ruifeng Chemical Co., Ltd. (China), Mitsui Chemicals, Inc. (Japan), Wacker Chemie AG (Germany), Formosa Plastics Corp. (Taiwan), Sundow Polymers Co., Ltd. (China), SI Group, Inc. (US), Akdeniz Kimya San. ve Tic. Inc. (Turkey), ), En-Door (China), Novista Group (China), and Indofil Industries Limited (India) and among others. These players have been focusing on developmental strategies, such as acquisition, new product launch, expansion, and partnership which have helped them expand their businesses in untapped and potential markets.

To know about the assumptions considered for the study download the pdf brochure

Kaneka Corporation is one of the largest chemical manufacturers globally. Kaneka Corporation is engaged in the business of manufacturing and selling functional plastics and chemicals through its subsidiaries in the US, Belgium, Singapore, Malaysia, China, Australia, Vietnam, India, South Korea, and Taiwan. The company is focusing on increasing its foothold in the global market. It has undertaken strategic initiatives to encourage innovation, strengthening its position in the PVC additives market.

Arkema S.A. is one of the leading producers of specialty chemicals and advanced materials in the world. The company operates through three segments, namely, high performance materials, industrial specialties, and coating solutions. Additionally, the high performance materials segment consists of specialty additives, technical polymers, and performance additives. Moreover, Arkema completed the acquisition of its partner’s stake in Taixing Sunke Chemicals, its joint venture manufacturing acrylic monomers in China. With the acquisition, Arkema has become the sole shareholder of the company. With this transaction, the company would be able to support the growth of its customers in Asia and benefit from greater flexibility to run this business in a region which accounts for more than 50% of the global acrylic acid demand. This would also help in the uninterrupted supply for acrylic monomer for manufacturing acrylic base impact modifiers.

Mitsui Chemicals, Inc. (MCI) is a chemical manufacturing company that offers a wide range of chemical products that are used in day-to-day lives. Its major products consist of petrochemicals, basic chemicals, functional polymeric materials, polyurethane, fabricated products, and functional chemicals. The company adopts growth strategies to maintain its position in the market. For instance, in June 2020, Mitsui Chemicals and Prime Polymer, in which Mitsui Chemicals has a 65% stake, jointly established a company to build a new polypropylene plant in the Netherlands. The plant has a capacity of 30,000 mt/year, and operations had begun in June 2020. This expansion was done with a view of increasing demand for PP to meet light-weighting needs in bumpers, instrument panels, and more.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=58674504

Friday, 1 October 2021

Top Market Leader - Feminine Hygiene Products Market

The global feminine hygiene products market size is projected to grow from USD 20.9 billion in 2020 to USD 27.7 billion by 2025, at a CAGR of 5.8% during the forecast period 2020 to 2025. The growth can be attributed to the increasing female population and rapid urbanization.

Asia Pacific accounted for the largest share of the feminine hygiene products market in 2019. The countries considered for study in the Asia Pacific feminine hygiene products market include China, India, Japan, Indonesia, Malaysia, and Thailand. Growing disposable income, rapid urbanization, and awareness about menstrual hygiene management are driving the feminine hygiene products market in this region. Recently, the Indian government announced plans to invest USD 160 million in the Suvidha initiative, a scheme to ensure proper access to sanitary napkins in rural areas of the country. The government plans to provide biodegradable sanitary napkins to the masses at the cost of USD0.00014 through this scheme. The government plans to involve high net worth individuals (HNIs) and corporates to assist in distributing sanitary napkins to underprivileged women across the country. These developments will further boost the demand for feminine hygiene products.

To know about the assumptions considered for the study download the pdf brochure

Johnson & Johnson (US), Procter & Gamble (US), Kimberly-Clark (US), Essity Aktiebolag (publ) (Sweden), Kao Corporation (Japan), Daio Paper Corporation (Japan), Unicharm Corporation (Japan), Ontex (Belgium), Hengan International Group Company Ltd. (China), and Drylock Technologies (Belgium) are some of the leading players operating in the feminine hygiene products market. These players have adopted the strategies of acquisitions, expansion, and product launches to enhance their position in the market.

Procter & Gamble, in February 2019 acquired This is L., a period care startup that manufactures organic pads and tampons. Procter & Gamble operates in more than 180 countries, with manufacturing sites present in 70 countries across the globe. The company is a global market leader in the feminine care category, accounting for a market share of 25% of the global feminine care market.

Kimberly-Clark Corporation is one of the leading manufacturers of family care, baby and childcare, adult and feminine care, personal care, and professional products. The company’s feminine hygiene products are sold under several well-known brands, such as Kotex, Intimus, and Camelia. Kimberly-Clark not only produces essential hygiene products but also encourages and supports open dialogs to banish bladder leak insecurities. The company is also involved in several social programs. Kimberly-Clark Corporation, in October 2020 acquired Softex Indonesia to accelerate growth in the personal care business segment across Southeast Asia.

Request for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=69114569

Subscribe to:

Comments (Atom)

Non-Biodegradable Plastics to Lead Bioplastics & Biopolymers Market During Forecast Period

In recent years, there has been a growing awareness that the use of non-biodegradable plastics is leading to large amounts of plastic waste ...

-

The global polylactic acid market is projected to reach $43.7 billion by 2024, growing at a CAGR of 5.2% from 2018. The industry is charact...

-

The global propylene glycol market was valued at USD 3.47 Billion in 2016, and is projected to grow at a CAGR of 5.8%, to reach USD 4.60 ...

-

In recent years, there has been a growing awareness that the use of non-biodegradable plastics is leading to large amounts of plastic waste ...